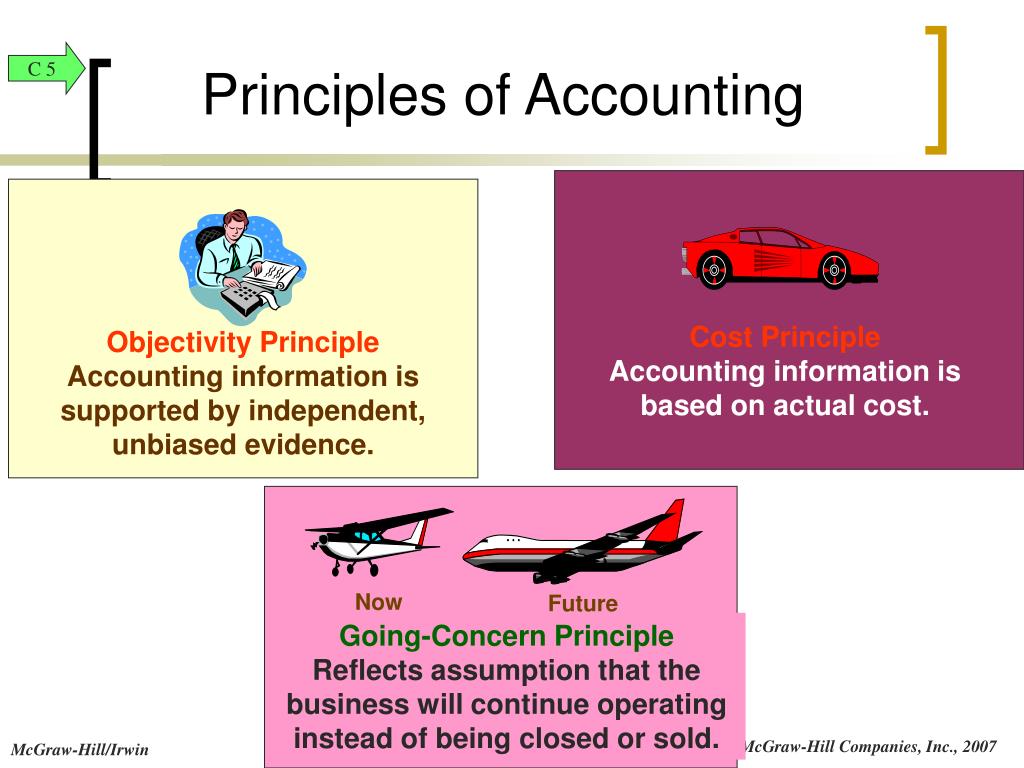

The matching principle is the basis of the accrual principle we have seen before. principle, a company may defer its depreciation or similar expenses for the next period. The company can operate until infinity is called the principle of going concern. This basic assumption allows the analyst to think that there is no immediate danger to the company. Therefore, by following the going concern Going Concern Any analyst analyzing a company will be left to a basic assumption that the company does not go bankrupt or file a chapter 11 bankruptcy. #4 – Going concern principle:Īs per the going concern principle, a company would operate for as long as it can in the near or foreseeable future. read more encourages the accountant to report more significant liability amount, lesser asset amount, and also a lower amount of net profits. In contrast, all the revenues and gains should not be recorded, and such revenues and profits should be recognized only when there is reasonable certainty of its actual receipt.

All the expenses and liabilities should be recognized. Conservatism principle Conservatism Principle The conservatism principle of accounting guides the accounting, according to which there is any uncertainty. As per the conservatism principle, the accountant should go with the former choice, i.e., to report the loss of machinery even before the loss would happen. Now the accountant has to choose one from two choices – first, ignore the loss the company may incur on selling the machinery before it’s sold second, report the loss on machinery immediately. Now, as the market changes, the selling value of this machinery comes down to $50,000. Let’s say that Company A has reported that it has machinery worth $60,000 as its cost. To understand this in detail, let’s take an example. As a result, it would be difficult for investors to see where the company has been going and how it is approaching its long-term financial growth.Īs per the conservatism principle, accounting faces two alternatives – one, report a more significant amount, or two, report a lesser amount. Management, investors, shareholders, financiers, government, and regulatory agencies rely on financial reports for decision-making. The reports reflect a firm’s financial health and performance in a given period. If the consistency principle is not followed, the company will jump around here and there, and financial reporting Financial Reporting Financial reporting is a systematic process of recording and representing a company’s financial data. If a company follows an accounting principle, it should keep following the same principle until a better one is found. As per the accrual principle, the sales should be recorded during the period, not when the money would be collected. For example, let’s say that a company has sold products on credit. read more in the same period it happens, not when the cash flow was earned. For example, Apple representing nearly $200 billion in cash & cash equivalents in its balance sheet is an accounting transaction. The company should record accounting transactions Accounting Transactions Accounting Transactions are business activities which have a direct monetary effect on the finances of a Company. Source: Accounting Principles () #1 – Accrual principle:

#Fundamental accounting principles how to#

You are free to use this image on your website, templates, etc., Please provide us with an attribution link How to Provide Attribution? Article Link to be Hyperlinked

0 kommentar(er)

0 kommentar(er)